Panoramic review of Mobile Healthcare Industry in 2014 (III): moves by industry heavyweights

Which industries have the most powerful enterprises in China? The answer is property development and telecommunications service. Leading companies in the two sectors have mobilized their business resources to gear up for an expected boom in the mobile healthcare market.

Property developers

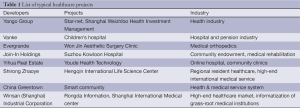

Property developers have some natural advantages when they decide to tap into the healthcare and pension industries. First of all, these industries require enormous initial investments, and property companies have strong financial strength. Secondly, property development will lead to population increase in a community and bring additional demand for healthcare and facilities and services for the old people. Property companies can get involved in building such facilities and providing such services and they are more aware of the service demands by local residents. Finally, their property projects can be valued higher if combined with leisure and health concepts. The three reasons are driving many property companies to explore business opportunities in the healthcare field. Here is a short list of typical healthcare projects invested by Chinese property developers (Table 1).

Full table

Yango Group

Yango Group announced on March 14, 2014 that it had set up a joint venture with Fujian Star-net Communication Co., Ltd to develop smart communities, smart home system and cloud-based call service center, and both parties established strategic partnership in these business areas. On July 3, Yango Group inaugurated its healthcare management department and established Shanghai Weizhibo Health Investment Management Limited to deepen its reach in the healthcare industry.

Vanke

Vanke is planning to build three children’s hospitals, separately in Guangzhou, Shanghai and Shenzhen, as China is in short supply of excellent hospitals that only treat child patients. When Vanke’s children’s hospitals gain broad popularity, they can offer better medical services to residents in the neighboring communities developed by it. Vanke has longstanding partnership with related companies offering smart healthcare and pension services to old people, and some pilot programs are running at its communities.

Yihua Real Estate

Yihua spent RMB 120 million to buy a 20% stake in Youde Health Technology, which is specialized in developing health information platforms and offering digital solutions and products to clients in the medical industry. They have built online clinics at 30 communities and chain drugstores across Guangdong to popularize their online medical services.

China Greentown

China Greentown has run programs that offer systematic health services and help residents improve their lifestyle and enhance their health conditions. It has forged partnership with Neusoft Xikang and other mobile health service providers to launch cloud-based healthcare services and health interventions at its upscale communities, and these services have improved the residents’ quality of life and enhanced its property management.

Winsan (Shanghai) Industrial Corporation

Winsan bought a stake in Shanghai International Medical Center that focuses on the high-end healthcare market. It increased investment in Shanghai Rongda Information Technology, which is among the earliest providers of IT solutions for grass-root clinics in China. Shanghai Rongda provides digital health software and solutions regarding digital hospital, electronic drug supervision and etc.

In conclusion, property developers are making inroad into the mobile healthcare market through the following means: investing in hospitals or health platforms that serve as carriers of mobile or remote healthcare services; acquiring health IT companies or buying a stake; partnering with hardware makers and mobile healthcare service providers. For most property companies, their push into healthcare market is only intended to offer more services and value to enhance the appeal and valuation of their property projects, that means they would never be a leading force in the mobile healthcare industry, and instead they position themselves as important participants.

Telecommunication operators

Just as the name implies, mobile healthcare could not function without the support of mobile Internet technology, and that makes a strong case for telecommunication operators to share a slice of the market. Deep-pocketed telecommunication operators have numerous phone users, tens of thousands of business offices and customer managers across the country, and they will definitely be formidable market players if they decide to foray into the field of mobile healthcare. It would be a great choice to establish stable partnership with telecommunication operators. Moreover, the application of high-speed 4G network has made the remote-visual-based mobile healthcare service technically possible.

China Mobile

Make initial presence in pivotal cities

China Mobile’s Beijing subsidiary has built an emergency medical information platform along with Beijing Red Cross Society’s 999 emergency centers, Peking Union Medical College Hospital and Peking University People’s Hospital. The platform will become a comprehensive system that can control the operation of emergency command center, distribute emergency ambulances and first-aid staff and determine which hospitals the patients will be sent to. As soon as it receives a call for emergency medical help, the command center will, based on the patients’ actual conditions, send the nearest ambulance and choose the most reasonable route to pick up the patients and transport them to hospitals where they will receive the best emergency treatment. In the meanwhile, the first-aid staff will receive remote instructions on how to deal with the patients, while the hospital will make preparations before patients are admitted.

Expand presence to rural regions

The huge urban market has been seen by telecommunication operators as an important part of their push into mobile healthcare. It’s understood that China Mobile has offered a series of mobile-phone-based medical services like doctor appointment, medical card verification, medical cost payment, medical insurance settlement to rural residents covered by the New Rural Cooperative Medical System in 13 provinces.

Cooperate with universities in technology development

China Mobile signed a strategic agreement with Central South University on April 9, 2014 to develop extensive cooperation in such areas as health-focused big data mining, mobile healthcare, regional healthcare and digital healthcare. Under the agreement, Central South University will design and develop the prototype system where the mobile healthcare applications will be ran, and China Mobile will build a cloud-based medical platform and offer technical support to facilitate the development of mobile healthcare applications. The two parties will also push for the sharing of quality medical resources with other regions and offer e-learning courses to rural doctors and medical school students in a bid to promote the sharing of medical knowledge and balance the allocation of medical education resources.

Other healthcare projects

China Mobile has so far launched several mobile healthcare projects, including sleep health remote monitoring system, heart function remote monitoring system, remote medical consultation system and a wireless hospital project. Its Shandong subsidiary has also played a role in building 40 health monitoring systems in 17 cities.

China Telecom

Cooperate with business partners at pivotal cities

The partnership between China Telecom’s Shanghai unit and Wonders Information focuses on data traffic and application pre-loading. China Telecom also markets Wonders Information’s full-range products at its business offices, including mobile healthcare solutions, remote diagnosis, online drugstores, delivery of drugs purchased online, as well as payment solutions for social insurance and commercial insurance customers. This partnership project has been carried out in ten districts and counties across Shanghai, but on-site inspections and data analysis suggest the project has failed to produce satisfactory results, because it’s basically a replicate of Neusoft Xikang’s business model, purchasing outdated but expensive medical equipment. Apart from a health examination center that recently opened and served internal staff and their families, other medical equipment are left idle and unused.

LifeWatch

In January 2014 China Telecom and LifeWatch, a Swiss company best known for its remote monitoring of heart functions, launched the world’s first medical diagnosis mobile phone. The phone is running on a mobile healthcare platform developed by Yun Hu Software Technology. But so far we have not seen the phone on the market.

Shanghai base for healthcare IT applications

The base is home to providers of integrated smart healthcare solutions, and these developers have released health-related applications, smart healthcare solutions, telecommunication solutions, as well as cloud computing and operation products. A smart hospital project has been implemented in the first people’s hospital, and a wireless hospital based on WiFi and new bluetooth technologies is also running at the Yueyang Hospital.

Remote regions

Three remote provinces and regions—Guizhou, Ningxia and Tibet—have worked together with several renowned hospitals, including PLA General Hospital and Peking Union Medical College Hospital, to build a remote healthcare platform. China Telecom’s Guizhou unit has made use of its network resources and service advantages to build IT network for the platform. The provincial people’s hospital, offering medical services to people in 25 counties (15 of them are national-level poor counties), is designated as the beneficiary of the remote platform and will be involved in its operation.

China Unicom

Build partnership in pivotal cities

In August 2014 China Unicom Shanghai, Shanghai Health Center and Taivex Health jointly released a healthcare product—cloud health—that can be used via text message, voice message and mobile application. Based on the residents’ health records provided by Shanghai Health Center, the product can make use of China Unicom Shanghai’s cloud computing capacity and data platform, integrate the medical resources of Taivex Health’s strategic partners and get them accessed to third-party platforms.

China Unicom Fujian

China Unicom Fujian joined hands with provincial health management center to establish a unified appointment, diagnosis & treatment platform, and on the basis of the platform, they built a cloud-based health management service platform. Under the Green Star Initiative launched in November 2014, China Unicom Fujian teamed up with a professional health management company to recruit 350 diabetes volunteers, who would be rewarded a cloud-based mobile blood glucose meter and 1-year glucose monitoring service. The cloud-based blood glucose meter is expected to be available on the market in early 2015.

China Unicom Fujian has also teamed up with Xiamen ZOE Software to offer healthcare IT solutions that include three major systems. The first is a mobile healthcare system that brings seamless integration between mobile care workstation and electronic medical records. The second is a mobile transfusion management system that aims to build a high-standard and high-quality new service model for transfusion procedures. The third is a coordinated mobile office system that can enhance work efficiency.

China Unicom Guangdong

China Unicom Guangdong and Guangzhou Pharmaceutical Group have cooperated on several projects like base coordination, community healthcare, IT system building, mobile infrastructure building, drug distribution system building and etc., and they have worked together to push the construction of a platform that allows users to buy drugs at online pharmacies and verify whether the drugs are authentic.

China Unicom Shijiazhuang

China Unicom Shijiazhuang has launched a smart healthcare system with primary focus on electronic drug supervision, mobile ward inspection, cloud-based storage of medical images. Electronic drug supervision is a distinctive program of the system that can trace the original source of the drugs. The company has also used mobile 3G technologies to build hospital’s internal network and install 3G signal receivers and terminal devices to verify the authenticity of drugs. Its technologies and products have been used by 800 drugstores and community clinics in Shijiazhuang to track the source of drugs, and local government is pushing to expand the system to the rest of the province.

Beijing Ouqiao’s “Heart Defender”

Beijing Ouqiao signed a strategic partnership agreement with China Unicom in May 2014. Under the agreement, Beijing Ouqiao will use its portable real-time electrocardio monitoring system, also known as “Heart Defender”, to offer health monitoring services to end users. China Unicom will provide mobile Internet technology and sales channels for the product.

Mindray Medical International Limited

Shenzhen-based Mindray Medical International Limited is one of the largest medical instrument manufacturers in China and has established comprehensive strategic partnership with China Unicom. With the help of China Unicom’s 3G wireless high-speed network, Mindray hopes to expand the use of its medical instruments beyond hospitals. At present it primarily targets such areas as emergency rescue, grass-root healthcare, and chronic disease prevention & control, aiming to build a sprawling network of emergency rescue through the grass-root medical institutions. It has also developed mobile healthcare solutions to help family customers control their chronic diseases and complications, but no specific product has hit the market. We believe such products are still under development and it will take more time to observe their impact on the market.

China Unicom has also joined hands with several hospitals in Shanghai, Shandong and Beijing to roll out mobile healthcare systems, and we would not elaborate herein.

Final words

Due to space constrains in the article, I could not share more information about other mobile healthcare projects carried out by local health authorities and technology R&D by some large hospitals. I would make further discussions in other articles about business actions taken by typical companies in the sub-industries of mobile healthcare. A splendid 2014 has passed, and more wonderful stories are going to happen in the future. Let’s work together and embrace the bright future for the mobile healthcare industry.

Acknowledgements

None.

Footnote

Conflicts of Interest: The author has no conflicts of interest to declare.

Cite this article as: Tu H. Panoramic review of Mobile Healthcare Industry in 2014 (III): moves by industry heavyweights. mHealth 2015;1:3